Global advertising spend is on course to fall by 10.2% – $63.4bn – to $557.3bn this year, led by sharp cuts in investment among the automotive, retail and travel & tourism sectors as a result of the Covid-19 outbreak finds WARC, the global marketing intelligence service.

Global advertising spend is on course to fall by 10.2% – $63.4bn – to $557.3bn this year, led by sharp cuts in investment among the automotive, retail and travel & tourism sectors as a result of the Covid-19 outbreak finds WARC, the global marketing intelligence service.

Do you want to see the future? Sign up for Campaign’s Marcomms360 Predictions 2021 virtual event on December 14-15. Registration is free.

The new projections, based on data from 100 markets worldwide, represent a downgrade of 2.1 percentage points compared to WARC’s previous global forecast of -8.1% made in May. It will take at least two years for the global ad market to fully recover, with a forecast 6.7% rise in 2021 only enough to recoup 59% of 2020’s losses. The advertising market would need to grow by 4.4% in 2022 to match 2019’s peak of $620.6bn.

Excluding the $4.9bn in campaign spending during the US presidential election cycle, the global ad market is set to contract by 11.0% – or $68bn – this year. In absolute terms, this is worse than the last recession in 2009, when the ad market contracted by $61.3bn (-12.9%). Further, after accounting for inflation, the real ad market decline is double the rate of the Great Recession.

Traditional media endure worst year on record

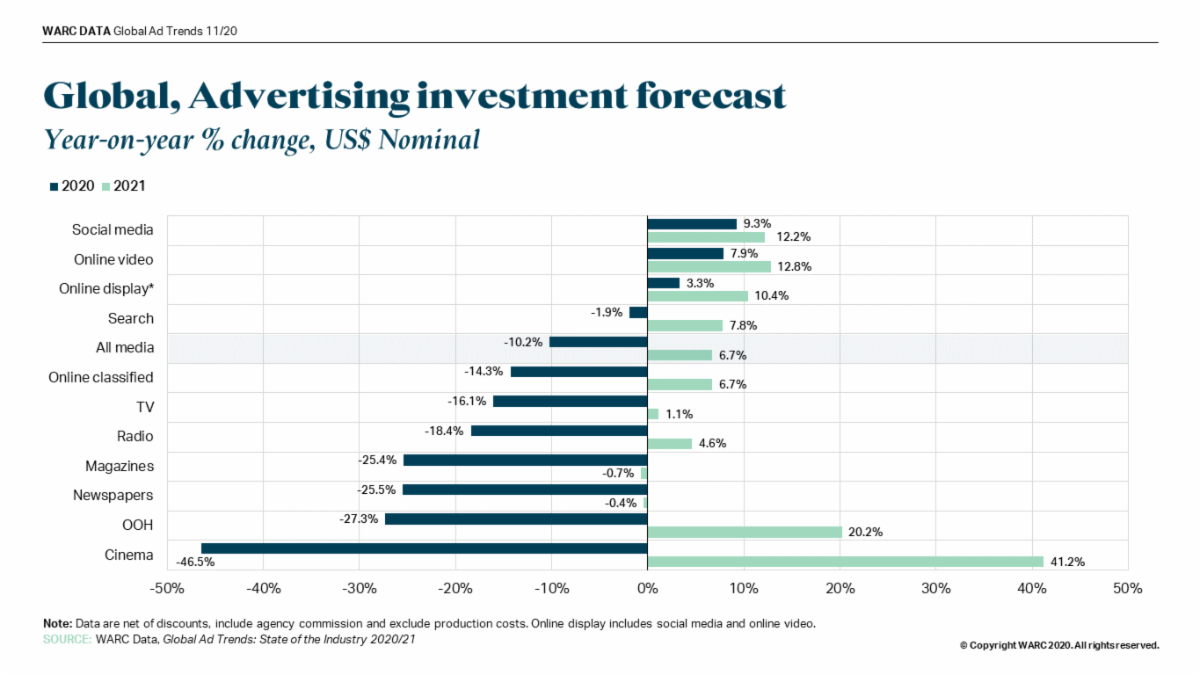

Traditional media have had a torrid year, accounting for the near-entirety of the advertising market decline in 2020. Globally, spend is down by a fifth (-19.7%), or $62.4bn, to a total of $253.9bn, with linear TV (-16.1%, down $29.9bn) seeing the largest absolute cut to ad budgets.

Cinema (-46.5%, down $1.5bn), out of home (-27.3%, -$11.3bn), newspapers (-25.5%, -$9.8bn), magazines (-25.4%, -$4.0bn) and radio (-18.4%, -$5.9bn), along with TV, all recorded their worst performance in WARC’s 40-year history of market monitoring. Most are expected to see growth in 2021, though this is more a reflection of a poor 2020 than a steady recovery.

The online advertising market – 54.4% of this year’s total – is flat (-0.3%) at $303.3bn, though this was the first year growth had not been recorded since the Dotcom crash in 2000.

Online video is the only ad format to have its prospects upgraded in the latest forecast; viewing leapt this year as nations imposed stay at home orders to quell the outbreak of the virus, and adspend is on course to rise by 7.9% to $52.7bn this year and a further 12.8% in 2021.

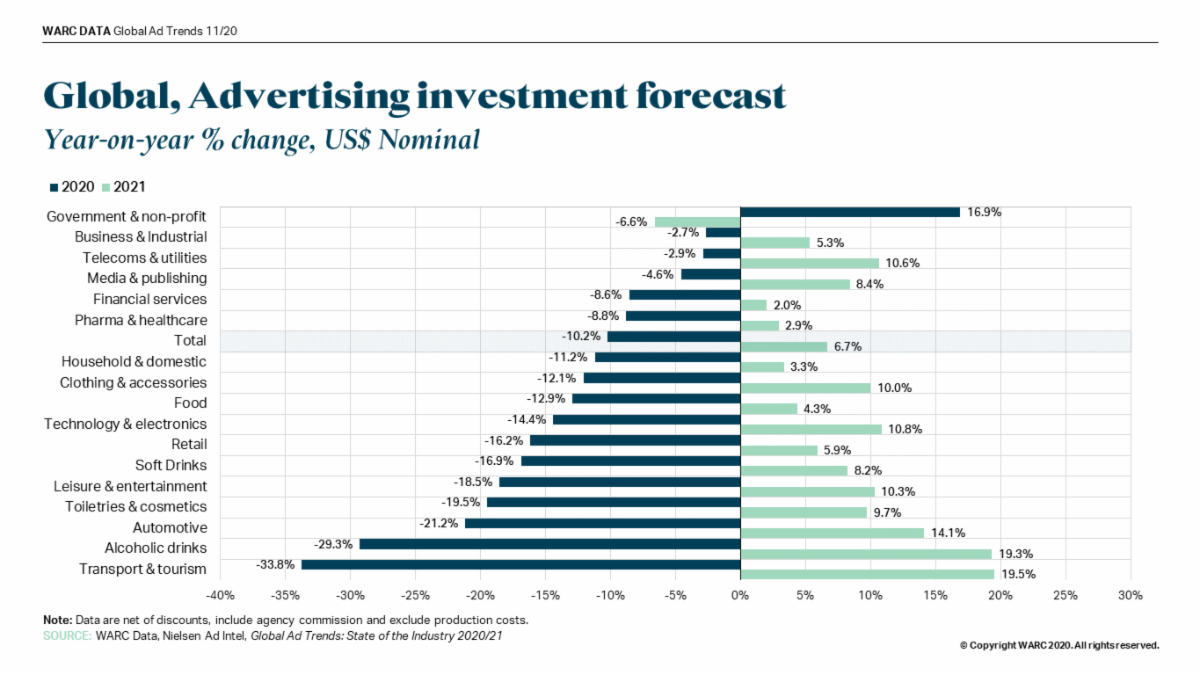

The automotive sector leads 2020 losses

Adspend within the automotive sector is down by a fifth (21.2%), or $11.0bn, to $41bn this year, meaning the sector is responsible for almost one in five (17.4%) lost dollars. The retail sector also curbed spend dramatically; a total of $54.3bn is 16.2% ($10.5bn) lower than in 2019.

The global pandemic acutely impacted the travel & tourism sector and this has resulted in adspend falling by more than a third (-33.8%, or $8.4bn) to $16.4bn this year. In a sign of the times, the government & non-profit sector was the only to increase adspend in 2020.

All product categories are set to increase advertising investment next year, with travel & tourism (+19.5%) leading growth, though only three sectors – telecoms & utilities (+10.6%), media & publishing (+8.4%) and business & industrial (+5.3%) – will top their 2019 total.

Summing up, James McDonald, head of data content, WARC, and author of the research, says: “2020 was the most hostile year for the advertising economy ever seen in our 40 years of market monitoring. Some platforms – such as e-commerce and social properties – have emerged from this year relatively unscathed, but the vast majority of the media landscape has witnessed a severe material impact.

“An immediate bounce back is not on the horizon; while growth is expected in most corners of the industry next year, this will be more reflective of a tumultuous 2020 than a sterling 2021. Rising unemployment is set to depress consumption demand well into next year, and though the prospect of a vaccination programme offers cause for optimism among consumers and businesses, it may only be a waypoint in a recovery that stretches two years.”

Trends by media and format

- Linear TV: Spend is set to fall 16.1% – or $29.9bn – to $155.6bn this year, 27.9% of all global adspend. This means 2020 was the worst year on record for TV. Despite a fillip from presidential campaign spending, the US TV market – the world’s largest – still fell by a tenth this year to $54.4bn. Globally, TV adspend is expected to rise by just 1.1% in 2021, leaving the market 15.2% lower than its pre-Covid total in 2019.

- Out of home: The OOH sector has suffered from a severe lack of reach during international lockdowns – spend is on course to fall by 27.3%, or $11.3bn, in 2020. Out of home is then forecast to be the second-fastest growing medium in 2021, with adspend rising by a fifth (20.2%), though a total of $36.3bn will be 12.7% lower than in 2019.

- Cinema: Like out of home, cinema advertising has been heavily impacted by lockdown conditions. Brand investment has fallen by almost a half (-46.5%) this year, but cinema will lead 2021 growth with a 41.2% rise.

- Linear radio: Investment in radio ads is projected to fall by 18.4% – or $5.9bn – this year, before rising by a mild 4.6% in 2021. This will put 2021 radio spend 14.7% lower than in 2019.

- Newspapers: Spend on print newspapers is down by $9.8bn – or -25.5% – in 2020. This is the worst performance for newspapers in more than 40 years, and the market is expected to be largely flat (-0.4%) in 2021.

- Magazines: Like newspapers, print magazines have been heavily impacted by reduced circulation. Advertiser spend has fallen by a quarter (-25.4%), or $4.0bn in 2020, with a similar level of investment forecast next year.

- Social media: Social formats, combined, were the strongest performers in 2020, recording total growth of 9.3% to $98.3bn. Social spend is then set to rise 12.2% in 2021, pushing the market to a value of $110.3bn, almost a fifth (18.6%) of all advertising spend.

- Online video: The only format to have its growth prospects upgraded spend is on course to rise 7.9% to $52.7bn in 2020. Online video is also expected to be the fastest-growing format in 2021, with spend up by 12.8%.

- Paid search: The search market is expected to decline by 1.9% this year before rebounding in 2021 with a growth of 7.0%. This would push the market’s value to $130.6bn in 2021, more than a fifth (22.0%) of all advertising spend.

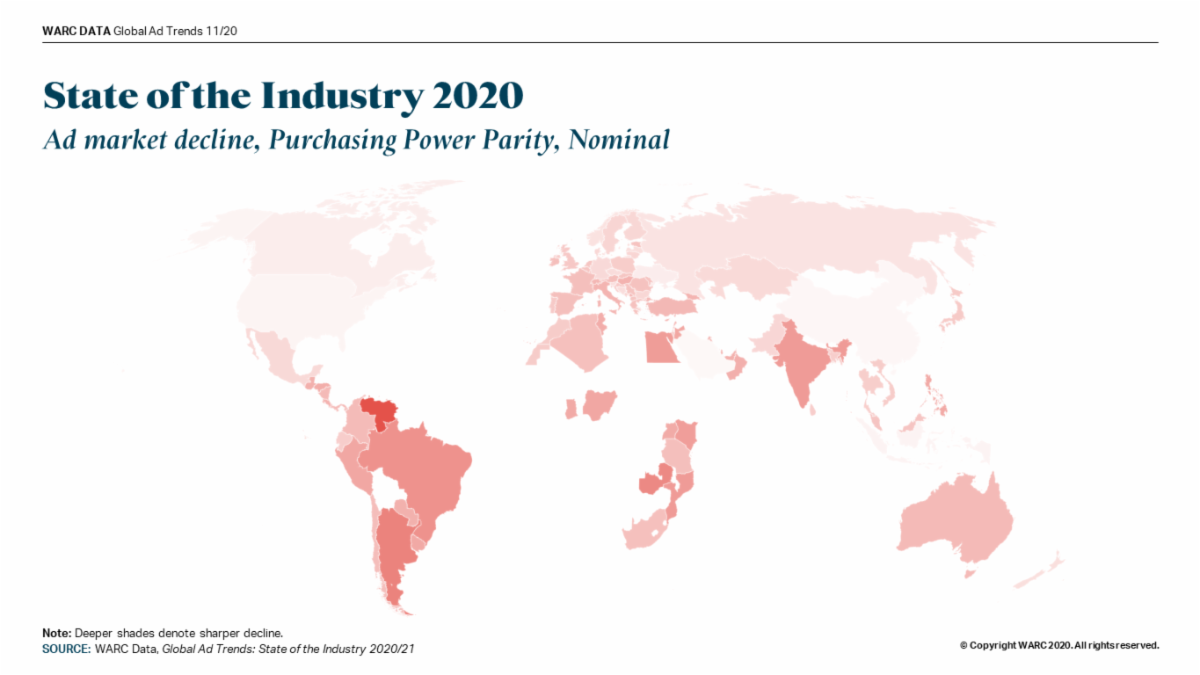

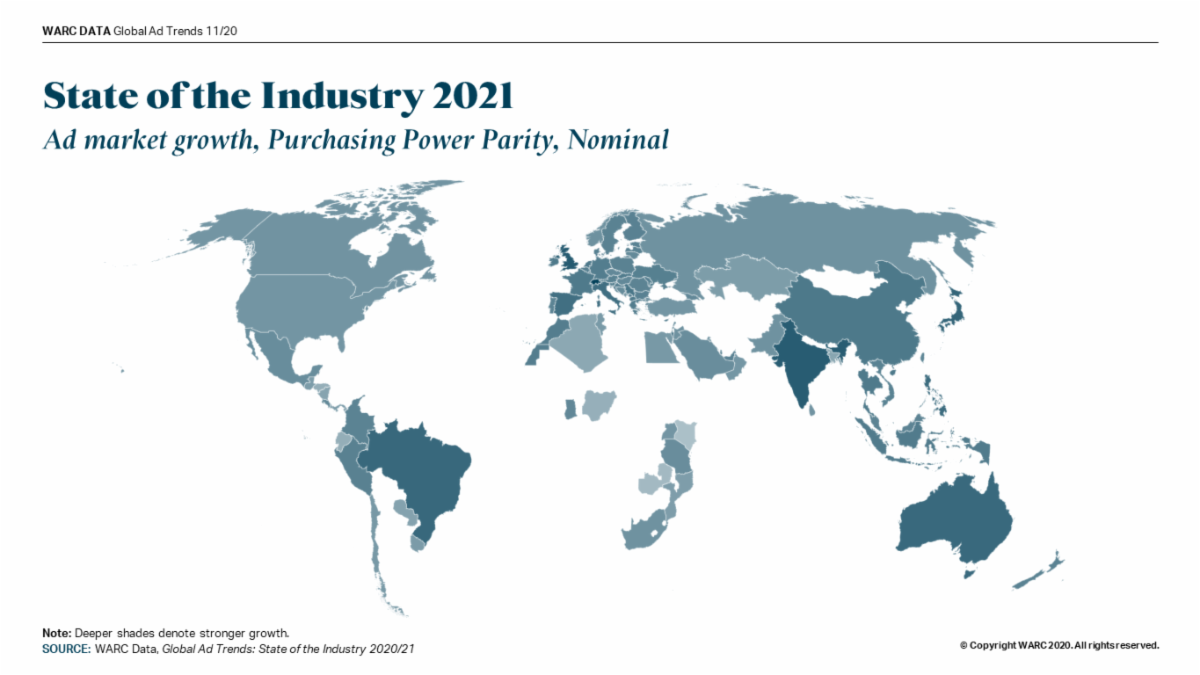

Trends by region

- North America: In North America, where 39.6% of global adspend is transacted, ad investment is down by 4.3% – or $9.9bn – to $221.0bn this year, encompassing a 4.1% fall in the US (down $9.0bn to $209.9bn) and a 7.8% dip in Canada (to $11.1bn). The region will see spend rise by 3.8% next year, with the US recouping 89% of 2020’s losses.

- Asia-Pacific: Advertising spend is expected to fall 9.7% ($18.8bn) to $174.4bn in 2020, before rising by 8.5% in 2021. China (+7.7%, up $6.5bn to $91.8bn), Japan (+10.2%, up $3.8bn to $41.6bn), Australia (+13.2%, up $1.3bn to $10.8bn) and India (+14.2%, up $964m to $7.7bn) are all set to record growth in 2021 following declines in ad trade this year.

- Europe: European adspend is down 14.5% – $21.5bn – to $127.0bn this year, with France leading key market decline at -16.7% (down $2.7bn to $13.4bn). The region is forecast to grow by 10.2% next year, recovering 60% of 2020’s losses. The UK (+14.7%, up $3.9bn to $30.6bn), Germany (+9.0%, up $2.0bn to $24.6bn), Spain (+12.5%, up $783m to $7.1bn), France (+7.1%, up $593m to $14.4bn), Italy (+11.3%, up $851m to $8.4bn) and Russia (+6.8%, up $579m to $9.1bn) are all set to see ad market growth next year.

- Latin America: Adspend is projected to fall by almost a third (-32.3%) in 2020, led by a sharp decline in the largest market, Brazil (-43.2%, down $6.5bn to $8.5bn), though this is inflated by a sharp devaluation of the Brazilian Real against the US dollar. Spend is expected to be flat in Latin America next year as the greenback remains strong.

- Middle East: While not as severely impacted by Covid-19 as other regions, adspend in the Middle East is still set to fall by a fifth (20.2%) – or $2.9bn – to $11.3bn in 2020, as oil-rich economies suffer from falling commodity prices. Growth of 7.0% is forecast for next year.

- Africa: Spend is expected to fall by almost a quarter (23.3%) to $5.0bn this year, with a mild rise of 2.1% expected in 2021 as key markets start to recover from sustained recessions.

Trends by product category

- Telecoms & utilities: 2021’s biggest expected category saw only a minor decline in 2020. Global advertising spend is projected to fall 2.9% (down $2.1bn to $70.4bn) this year and then rise by double-digits in 2021 (+10.6%, up $7.5bn to $77.8bn). Online spend is forecast to grow by 5.6% in 2020 with this accelerating to 11.5% next year. Although all traditional media will see higher investment in 2021, these levels will remain below 2019 spend.

- Media & publishing: Advertising spend from media brands is expected to top $70bn worldwide next year for the first time, growing 8.4% (up to $5.5bn to $71.4bn). This follows a projected 4.6% decline in 2020 (down $3.2bn to $65.9bn). TV advertising is expected to see the softest decline among traditional media this year (down 10.9% to $16.1bn) but is also forecast to see a 1.4% contraction next year.

- Business & industrial: Investment is projected to remain relatively flat for business advertisers, with an expected drop of 2.7% (down $1.7bn to $60.8bn) this year being the softest rate of decline among all categories. Growth of 5.3% (up to $3.2bn to $64.0bn) projected next year means 2021’s investment will be only 2.5% higher than in 2019.

- Retail: Advertising spend from retailers will see one of the softest rebounds next year. Total investment is forecast to fall 16.2% this year (down $10.5bn to $54.3bn), with only an increase of 5.9% projected for 2021 (up $3.2bn to $57.5bn). Online spend is expected to drop 3.4% in 2020 but see 6.9% growth next year.

- Automotive: Social lockdowns have limited travel this year, though health benefits from private vehicles and delayed purchases mean 2021 is key for automotive brands. Advertising investment is projected to fall by one-fifth (-21.2%, down $11.0bn) to $41.1bn in 2020, one of the steepest rates of decline. However, the automotive category is one of few to see double-digit growth in 2021, rising 14.1% (up to $5.8bn) to $46.9bn.

A sample report of WARC’s Global Ad Trends: State of The Industry 2020/21 is available to download here. The full report is available to WARC Data subscribers.

This latest Global Ad Trends report complements WARC’s recently released Marketer’s Toolkit 2021, a guide to six major challenges facing brands in the year ahead, helping businesses plan in context and seek new opportunities to develop effective strategies for growth.

Global Ad Trends, a bi-monthly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments, is part of WARC Data, a dedicated independent and objective one-stop online service which rigorously harmonises, aggregates, verifies and evaluates data from over 100 reputable sources, including Nielsen, featuring current advertising benchmarks, forecasts, data points and trends in media investment and usage.