Tailwind brings you Covid-19 insights from GlobalWebIndex, a leading market research company operating in 45 markets inclusive of MENA. Tailwind, a TDG Company is the exclusive partner for GlobalWebIndex in the region, bringing to local businesses powerful consumer insights.

Tailwind brings you Covid-19 insights from GlobalWebIndex, a leading market research company operating in 45 markets inclusive of MENA. Tailwind, a TDG Company is the exclusive partner for GlobalWebIndex in the region, bringing to local businesses powerful consumer insights.

The luxury industry, with an estimated value of more than US$ 11.1 billion in 2019 in UAE (source), was one of the industries hit hardest during the pandemic. The reasons for this may vary but certainly the lockdown, and consumers’ natural prioritization of purchasing essential goods instead of luxury items played a large role (source). Our recent, multinational, study presents emerging key trends in the luxury market that the industry should take into consideration right now. Read the full report on affluent consumers here.

Luxury shopping is going virtual

As in many other industries, the pandemic has forced digital transformation into the luxury sector. Luxury goods are usually sold in physical locations because they are considered “high touch” products and require an advanced level of engagement and interaction by the consumer. Luxury consumers are adapting to this reality also, among respondents who’ve delayed buying luxury items due to the pandemic, over half will buy more items online using home delivery once it’s over. Additionally, the majority of the luxury buyers (77%) agree that what matters the most when buying such a product or service is the community and experience built around it. This might mean than the physical location that the product was bought in plays a secondary role. The luxury industry should be keeping a close eye on the transformation of luxury shopping and how it can provide stand-out service on an online platform. Already, major luxury brands like Dior and Louis Vuitton are riding the wave on providing a virtual shopping experience, by launching their e-commerce platforms in the Gulf region (source, source).

Luxury & Affordability: a match made in heaven

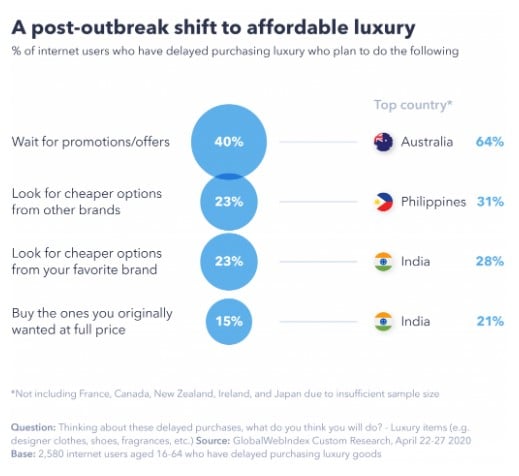

In the recent years, affordable luxury has become popular among consumers who want luxury goods and the status that comes with them but are concerned with the price. As a result, this type of consumer behaviour has affected also the traditional luxury industry. Socioeconomic, COVID-19 related implications helped to accelerate this trend and now more consumers seem to have abandoned traditional luxury and seek luxury alternatives and payment plans. When asked on the aftermath of delayed luxury purchases due to COVID-19, 3 in 10 consumers globally respond that their top priority on such purchases are flexible payment options- 54% more likely to say this than the average. Additionally, only 15% of the respondents agree that they’ll buy the items they originally wanted at full price, while 40% will wait for promotions, and 23% will look for cheaper options from other brands. In this article around consumers’ luxury spending behaviour in UAE, shoppers admitted that they are conscious about the prices, and among others, they will wait to purchase luxury items in the sales, or buy these items in outlet malls. Consequently, brands need to find the balance between bringing more affordable luxury to consumers, without diluting their values and purpose.

Sustainability gets the luxury treatment

Additionally, not only their financial but also consumers’ ecological concerns are turning them into more sustainable options when it come to the purchase of luxury items. With 7 in 10 feeling there’ll be of heightened importance to reduce their personal carbon footprint/environmental impact, it is only normal that second hand websites like Vestiare Collective or Fashionphile have become a household name among fasionistas who are looking for responsible luxury (source). This trend has now been gaining ground in UAE as well, where in Dubai, consumers have a variety of options to shop second hand luxury clothes like garderobe.ae and theclosetonlineshop.com. Brands should pay attention to this shift of consumers’ behaviour and find ways to capitalise on that and gain more control on the channels that the second hand clothes are distributed.

What is the future of the luxury sector?

It goes without saying that COVID-19 had a significant negative effect on the luxury industry. Nevertheless, interesting trends have emerged through this challenging period. Although pandemic halted consumers’ spending, this is a good opportunity for brands to reflect and re-examine their strategy and consumer approach overall. As well as employing activations to stay top of mind for consumers during the outbreak, brands should be inventive on the ways they reach consumers, such as using online channels, while assessing potential methods of bringing more affordable luxury & sustainability to consumers and at the same time staying authentic to their brand values.

Tailwind and GlobalWebIndex are strongly committed to keeping Covid-19 insights free to all during this challenging time. For more insights and upcoming research, you can find all of GWI’s Covid-19 related free resources here.