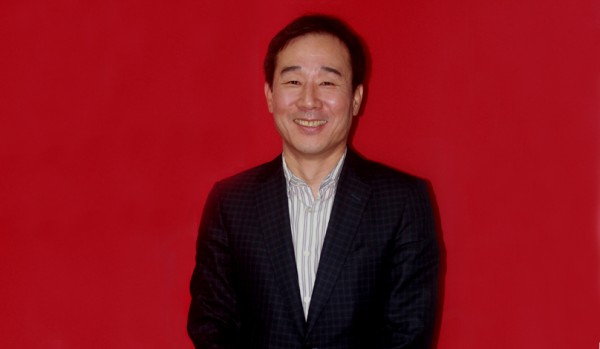

Besides expanding in the Middle East, its second-fastest growing market, Cheil will look to build digital planning and buying capabilities globally, and continue to scout for acquisitions, says global COO Michael Kim.

Almost every story on Cheil’s global growth since 2008 has pointed to the South Korean agency brand’s ‘struggle to emerge from Samsung’s sha-dows’. Every acquisition, be it of The Barbarian Group or BMB and McKinney, has raised this question. Cut to 2014, when the agency acquired stake in yet another agency, Iris. By this time, there were enough reasons to believe that Cheil had moved significantly in the direction of becoming an independent global network. Samsung still looms large, but it has done more good for the agency’s diversity than meets the eye in the headlines.

Kim’s first overseas assignment was when Cheil started its ‘global business unit’ in 1995. There were liaison offices since 1987, but the first business offices came eight years later. The first ones were in New York, Los Angeles, Frankfurt, Tokyo and London. The ‘small offices’ were primarily for gathering information and learning advanced industry trends.

So less than 10 years ago, it was a 100 per cent Korean domestic agency creating advertising campaigns. Today, it has 48 offices in 41 countries with over 5,000 employees.

Over 75 per cent of the agency’s revenues are now being generated in overseas markets, including that of affiliates. In the South Korean market, the agency had grown beyond Samsung much earlier. The global business unit has understandably grown with Samsung, and now, with the strength of acquisitions, and specialist offerings in digital and retail taking wing.

“At the end of 2010, over 90 per cent of the global business unit’s revenue was coming from Samsung. Today, it stands at less than 65 per cent. We successfully diversified our revenue stream from one client to many other global and local clients,” explains Kim.

If one were to not factor in affiliates (acquired companies), Cheil’s revenues from Samsung outside South Korea would be at 80 to 85 per cent. But while there is still dependence, there is a conscious effort to grow beyond.

The agency’s current thrust on growth is evident in its new hires. Malcolm Poynton has been roped in as the agency’s first chief creative officer. Also in January 2015, we were informed of Lotta Malm Hallqvist coming on board as chief growth officer. The moves are part of the effort to establish the group as a differentiated global network. They are part of a global network development team.

“Thanks to Samsung, we have accumulated great success stories across the world in the last 10 years. We have learnt a lot from those experiences. And this is a great time for us to grow beyond Samsung,” said Kim.

Beyond advertising

Thanks to Samsung, the agency has also diversified beyond the ‘storytelling’ domain of the advertising business into the realms of digital and retail. This has also helped Cheil get a foot in the door into clients with established relationships with ‘traditional’ agency partners.

In the Middle East for example, Cheil got onto Coca-Cola’s roster last year with its digital capabilities, winning the mandate to handle the regional edition of Coke Studio. Also among clients is telco du.

Kim reveals that since 2011, a lot of emphasis has been placed on digital and retail experience globally. The results are showing. With the caveat that there is a lot of overlap that comes in the way of bucketing revenues, this is how the global COO sees it: the combined contribution of ‘digital and retail’ has gone up for Cheil from 25 per cent in 2011, to over 60 per cent at the end of 2014. With experiential marketing (events) accounting for around 10 per cent, a little over a quarter of revenue comes from the ‘above the line’ advertising business.

Does he expect the digital and retail experience bucket to keep growing the fastest? “In the coming years, yes,” he says.

The fast-growth markets

The agency grew the fastest in China in 2014, followed by the Middle East. In the Middle East, the agency has expanded from two offices (in Dubai and Istanbul) to establish offices in Jordan and the huge market of the Kingdom of Saudi Arabia.

While growth across markets is on the agenda, the intent is to grow with a new, market-facing agency model. Evidence of that model exists in the revenue contribution from digital and retail experience practices.

“Today, the distinction between media and creative agencies has disappeared. The digital agency is trying to become the creative agency; the creative agency is also doing work like a digital agency; media is incorporating creative departments; retail specialists are offering integrated marketing services. That’s the trend. All agencies that had distinct product offerings in the past are getting integrated,” reflects the agency head.

Kim notes that the trend has engulfed Cheil as well, both in Korea and in other markets. Growing with Samsung to meet the burgeoning brand’s global needs has paid off for the agency. “Samsung has always wanted to provide distinctive experience in their marketing to consumers. We had to turn ourselves from an ad agency to an integrated marketing agency faster than anyone else,” he adds.

Building new capabilities

In an integrated world where media agencies are firmly involved in the digital arena, and playing with social and creative, could Cheil not having a media planning and buying offering be a disadvantage? Is that a gap in the portfolio? Media planning for the brand is handled by Starcom globally.

The executive argues that media planning per se is changing, and needs to be viewed with a different lens today. Clarifying that Cheil is not interested in TV planning, he notes that even planning for TV is changing ‘with everything moving towards social and mobile’.

“As the distinction has disappeared, we have to think about how to strengthen our digital media planning and buying capabilities. In China, we have very comprehensive media planning and buying services, as also in India. We would like to build that digital media services capability in other markets too,” he says.

“We’re not interested in volume, but in performance,” adds Kim.

Inorganic growth in data

Given the pace of change of the ecosystem, one cannot build all new and needed competitive strengths organically, underlines the COO, justifying the several acquisitions over the last few years and confirming that there will be more.

He emphasises that mergers and acquisitions by Cheil have not been to increase numbers, but to build capabilities to complement existing services. So where will the new ‘capabi-lity building’ happen? The agency is eyeing data and analytics, among others.

“For example, in markets like India and the US, where there exist good data analytics capabilities, we would be interested. We have the capability in the Korean market, which is mainly for domestic Korean business. We need to build this globally,” he explains.

Without divulging specifics on whether talks are on with potential partners / suitors in India or the US, he terms it ‘Work In Progress’.

The integration challenge

For an agency that has spent many years by itself (b. 1973), the deluge of acquisitions in the last few years has come with attendant challenges. Kim cedes that it is very difficult to successfully integrate agencies with different cultures.

He adds, “I cannot say that every integration has been successful. We have had good times and tough times. We have learnt that to make integration work, we have to find the right partner who shares our vision and culture. If we find the right partner, the integration success rate will dramatically increase.”

There are cases where different units have come together seamlessly, something Kim and team would like to see more of. One such example is Samsung CentreStage, which made headlines last year – an interactive visual retail stage for home appliances.

To realise that idea, Cheil headquarters in South Korea needed the skillsets of its affiliate in the US, The Barbarian Group. “Without them we couldn’t have made it,” adds Kim.

The newly formed global leadership team, including affiliates, share business information and data in an integrated process, exploring synergies.

The Middle East

The agency is keen to explore business opportunities in Qatar, Lebanon Iran and Eqypt in 2015. Here too, the agency is keen to handle the needs of Samsung, but also look beyond the brand at other opportunities.

Before establishing legal entities in those markets, the idea is to test whether it is ready to enter them with existing skillsets and understanding, or consider an alternate approach. But they are on the radar and the agency will start offering services in those markets this year, exploring the best route, according to its global COO.

And especially in markets like Dubai, Turkey and Jordan, where the agency’s operations have stabilised, the intent will be to look beyond growth from Samsung.

Keesoo (Kim), president and head of MEA headquarters, Cheil, noted that since 2012, the agency has doub-led in headcount year on year, with the current staff strength at 490 people in the region (including One Agency, the group’s retail production company).

Iris, the most recent acquisition, has a presence in the region too, though it is admittedly too early to discuss synergies.

“If we need to, we will look at inorganic growth in this region as well. We have been building partnerships with other agencies to build our capabilities and services, not to increase turnover like other holding companies,” retorts the Cheil COO, when asked about the possibility.

Asian dynamics

There is a school of thought that says Japanese networks like Dentsu, and to some extent Hakuhodo, have benefited from a number of Japanese brands going global. They have grown alongside. It’s not the same with Cheil which has had one brand in Samsung, or for that matter Innocean which has been built on Hyundai. Point this out and Cheil’s COO breaks into a smile.

“I cannot express the gratitude Cheil feels for Samsung properly. Samsung has helped us grow tremendously in global markets,” he notes. And adds, “If we had one more Samsung-like client, our status might be very different today. But the Korean economy is very small compared to Japan’s. So we cannot blame the reality. But the reality gives us braveness. And I believe in terms of our spirit, culture, management style, we are more flexible and more globalised… in Asian markets at least.”

He is quick to add that agency has immense respect for its Asian counterparts, having learnt from them as much as from Leo Burnett or another agency network. And quips, “We adapt to what we have learnt and change ourselves with the learnings. It’s about adapting fast.”

The creative identity

Another aspect of the agency that has been scrutinised has been its creative reputation. It’s not something that has missed the attention of COO Kim, who concedes that it has been lacking in the past, but underlines that things are changing.

“There is a need to build the creative reputation. That is the only way to increase growth. It’s a virtuous cycle between great work, which brings in client business, which attracts the right talent, which in turn builds reputation,” he adds.

He notes that four years ago, it was very hard for Cheil to attract the kind of talent that is able to today. Kim credits it to more Cannes Lions, among other awards, as also to the acquisitions the group has made. And he expects more campaigns of the Samsung ‘Bridge of Life’ variety to come out of the agency.

“We have made more noise in the last few years through our work and awards. Finally, we could draw attention from the market as an independent global company. Across a majority of offices, we have been able to attract globally well-known talent as a result,” he says.

And adds, “Today, people are watching what Cheil is building.”

We certainly are.

(This article appears in the issue of Campaign Middle East dated 8 February 2015.)