2018 has marked the anniversaries of several important events, including 100 years since the end of World War One, 50 years since the assassination of Martin Luther King Jr and 10 years since the start of the financial crisis. The common link between all these events is that they still resonate today.

Take the financial crisis. Even though we hear forewarnings of another financial meltdown, we still haven’t recovered from the last one. Forecast at $3.3bn in 2018, the MENA advertising market will have fallen back to levels last seen in 2004, never mind recovering to those of 10 years ago. In the last 14 years, we’ve certainly had few ups and plenty of downs.

Nevertheless, we’ve managed to deal with the usual stress factors, such as fluctuating oil prices, geopolitical tensions, conflicts and pressure on margins and budgets. These clearly do little for advertisers’ optimism, but it gets worse when we add unpredictability, like the events at the Ritz-Carlton a year ago. The impact on business confidence was so strong that it negated the positive vibe of the reforms Saudi Arabia engaged in before and since. Instead of the bottoming-out that I foresaw last year, I anticipate that 2018 will close with a drop of 6 per cent on the previous year. The 20 per cent increase in digital investments will not be enough to compensate for the 16 per cent fall in traditional media. In this climate, media merger and acquisition activity has dwindled to nothing. Two misses out of 12 predictions for 2018 isn’t too bad.

Be they structural or cyclical, most of the underlying trends of the last few years will continue to transform our market and our industry. While the region’s GDP is forecast to grow by up to 3 per cent next year, we should see a softer contraction in media investments. There is little prospect for a reduction in regional tensions.

What’s absolutely certain is that the transformation of our business is picking up pace and the trends reshaping it are getting stronger and more acutely felt. Data-driven, content-driven, customer-centric marketing

will quickly move from the exception to the norm. Scale will need precision and relevance

to work. These journeys are built of smaller steps, though, and we must look more closely

to see what we will be dealing with in the region next year.

1. Pressure on incomes will affect consumer behaviour

With the introduction of VAT this year and the reduction of subsidies on fuel and electricity, consumers in the Gulf are finding it increasingly hard to make ends meet. This is leading to a growing demand for deals, promotions and other special offers. A recent study estimates that some 55 per cent of Middle East consumers, especially in Saudi Arabia, are becoming more cost-conscious and less brand-loyal, actively seeking cheaper alternatives. Almost eight in 10 have changed their buying habits to save money. The days of care-free spending may well be behind us. Some brands are reacting accordingly, while entrepreneurs are busy promoting online services to compare providers in various sectors. This will only strengthen the move from memorable brand-building advertising to attention-grabbing offer-led ads.

2. E-commerce will double

Valued at about $10bn (excluding travel, hospitality and utilities) in the region, retail e-commerce can appear impressive but it is only 3 per cent of the total retail market. Our malls won’t turn into ghost towns any time soon. Still plenty of room to grow for e-commerce, and it is expected to do just that, doubling next year and even tripling in the next three years. Social commerce, through Instagram for example, will help get more people to buy more online. We’re certainly seeing more and more brands, retailers or otherwise, strengthening their position in this space.

3. Two will become three at the top of digital

In the last 10 or so years, Google and Facebook have witnessed exponential growth in audience, usage and revenues. Together, they will claim about a third of total media investments next year. However, with such rapid growth, a few cracks have started to appear and concerns over their influence, accountability and integrity have dented their reputation. Their growth will slow down as they embrace higher editorial and commercial standards. Twitter and Instagram have already been busy cleaning up and removing fake accounts and interactions. While Snapchat hasn’t shone particularly brightly globally in 2018, its regional performance makes it a force to be reckoned with. Its popularity, particularly in Saudi, will see Snapchat join Google and Facebook in a regional triopoly, thanks to revenues that will far exceed $100m next year.

4. TV drop will slow

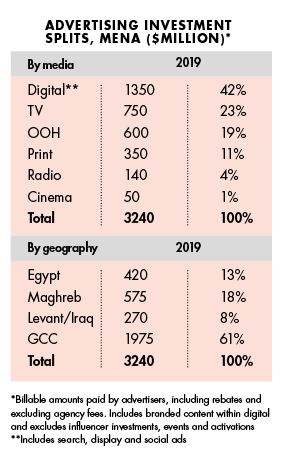

The share of digital will continue to rise, reaching 42 per cent next year, thanks to the digital duo. This is at the expense of most other media, even TV, which will see its advertising investments drop again, albeit less sharply than in the past. At 23 per cent, the share of TV in MENA will be about half of digital’s and lower than the global average of 33 per cent. Concerns over TV measurement, a focus on performance over branding and pressure on budgets have pushed investments to a point below which brands will start hurting. A rebalancing will come from this realisation. Another development that will renew advertisers’ interest in TV is the rapid growth of IPTV homes in MENA, rising three times faster than satellite homes, as this willl make addressable TV possible.

5. TV data streams will soon flow in KSA

Another reason for the forthcoming bounce-back in TV advertising is that despite this region’s very patchy record with media measurement, we’re finally seeing progress with people meters in Saudi Arabia. The Saudi Media Measurement Company (SMMC) partners are working towards starting operations in 2019, with data streams expected in 2020. Compared with more mature markets that are now looking beyond people meters, we may be behind the curve, but at least we’re about to be on it.

6. Powerful media brands will act as beacons

While the long tail has a role to play and a place in most advertisers’ plans, next year we will see a growing focus on valuable and recognisable media brands. Safety and quality concerns, along with a decreasing appetite for risk-taking, are pushing brands towards known quantities. These meet consumers’ needs to slow down and let go of superficiality, focusing on quality, reliability and credibility instead. We expect to see an even stronger move towards premium inventory and formats, as well as further investments in fraud prevention measures. Despite the raft of scandals and issues, this is unlikely to affect Facebook.

7. Influencers will keep rising through the ranks

Far from being a passing craze, influencers are here to stay and grow. As they generate impressive results, they will keep on commanding more and more attention and budgets. At $100m, the sector is challenging radio for the fourth spot in media rankings. With this scale, it’s no wonder we’re seeing increasing regulation and rising industry standards. Developments with data are leading to a shift from macro- to micro-influence at scale. If macro-influencers still claim half the market, mid-level bloggers and micro-influencer platforms are witnessing significant growth from their respective 40 per cent and 10 per cent share. Huda Kattan may well be the centre of attention, but her gloss shouldn’t mask the fact that there are endless options and opportunities.

8. Some established publishers will teeter on the edge of the abyss

Digital advertising has trounced the print sector for a while now. In order to claw back revenues, some publishers are reaching new depths to monetise content and audiences. These schemes are often at the cost of their editorial integrity, with mentions and favourable coverage now making it onto a rate card. This path will ultimately take them to oblivion and irrelevance because it leads to a fatal loss of their readers’ trust. It’s time for a new approach. A sustainable model isn’t built on display advertising or even video, but on a smart branded-content strategy, events and e-commerce. Publishers will also need new leadership to weather the storm and set a new course.

9. Marketers will focus more on advertising infrastructure

The decrease in paid advertising in legacy media is partly linked to the fact marketers are moving increasing portions of their budgets to other areas. These include technology, data and analytics, experiential and content creation. It’s a sign of both the disaffection with interruptive advertising and the proven performance of more tailored communications. Brand-building remains important, but most clients will keep on aiming for higher conversion and sales, looking for more instantaneous results rather than long-term ones. Data and tech reach beyond advertising, of course, and the investment in this infrastructure supports the transformation of businesses across many facets. In the USA, studies show that analytics budgets will triple in the next three years.

10. Consultancies and in-housing will complement, not threaten, agencies

Much has been made of how digital transformation is creating a new front between management consultancies and advertising/media agencies. While there certainly is a growing commonality in the type of consultancy services both are offering their clients, media and advertising agencies will continue to dominate in the marketing services arena. Brands and consumers are not consulting firms’ natural territory and, even with acquisitions, consultancies will take time to adapt. They also still need agencies to execute their recommendations. Some clients are in-housing certain aspects of their marketing, such as social media or data and analytics. As most aren’t fully resourced to excel at this yet, in-housing will only accelerate our own evolution towards marketing consulting. Agencies will learn to let go of their inferiority complex and focus on the value they demonstrably add to their clients’ business.

11. Talent reorganisation will increase

Both the cost of employment and the cost of living are increasing in the GCC, putting a strain on businesses and individuals alike. Even the service industry is exploring ways to alleviate the problem with new structures. Offshoring will certainly increase in popularity, leading to the relocation of several functions to lower-cost markets. The result will be leaner in-market operations for agencies, with client-facing, consultant-type staff on the ground. The agency of the future will be under more than one roof.

12. More companies will realise

the value of culture

If technology is relatively easy to secure or replicate, talent is crucial because it is ultimately the true differentiator. A strong corporate culture helps attract, nurture and retain the talent a company requires, for both today and tomorrow. In order to support the transformation of their service offering by elevating both the skillset and resident knowledge, training, re-training, agile team structures, innovative work organisation and attractive career paths will increasingly form part of companies’ talent plans. Next year, we will see them investing even more into their talent and culture to stimulate growth in their teams and business.

There is no doubt that our industry is relying more and more on hard facts and evidence. This can only lead to a strengthening of advertiser confidence and higher investments, particularly if they can be linked to higher sales and profits.

There is no doubt that our industry is relying more and more on hard facts and evidence. This can only lead to a strengthening of advertiser confidence and higher investments, particularly if they can be linked to higher sales and profits.

Advertising is at a turning point. The shrinking of the purchase funnel has seen the industry focus more on the conversion to sales and transactions than on brand metrics. We’re also moving from mass marketing to individual marketing at scale. This is forcing not only a rethink but also a transformation in terms of services, people and structures. What doesn’t change is our mission to deliver real and demonstrable value to our clients, in business impact rather than proxy media measures.

What complicates things is that this notion of value is changing over time and so are the ways to derive it. We’re being presented with bigger briefs, with higher goals and ever more daunting challenges. And we successfully address them. We have an innate curiosity, ingenuity and resourcefulness that allow us to prevail in such conditions. For all the clouds on the horizon, if we aim high enough we’ll eventually find the sunshine.

It’s when times are tough that we are at our most innovative and creative. As the only region in the world where advertising investments have been falling year-on-year, we are certainly being tested. No, we’re not dinosaurs and extinction isn’t our destiny. This is our chance to truly prove our mettle and show the difference we can make – to our clients, to their consumers and to ourselves as an industry.